How to Borrow Yama

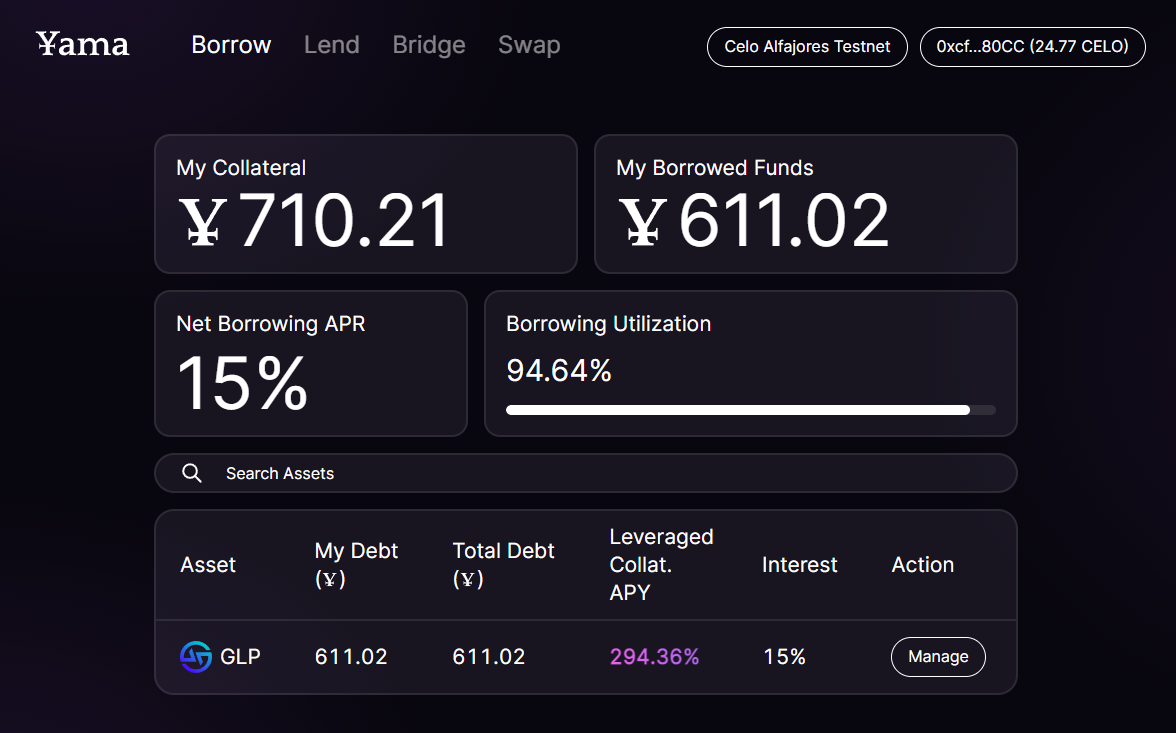

The Yama Finance protocol allows you to create a vault, add collateral to that vault, and borrow against it.

Yama Finance is a modular protocol, so the current CDP module allows for zero and negative interest rates to be set. That way, governance can yield farm the collateral and collect the rewards in lieu of interest.

Note that if the ratio of debt to collateral goes under the collateral ratio, the entire vault's contents will get liquidated. This provides an incentive to remain overcollateralized.

Also note that a vault's outstanding debt must either be 0 or a number that is greater than or equal to the debt floor of the collateral type. You will not be permitted to borrow or repay your debt if it causes your debt to be greater than 0 but lower than the debt floor. This has been implemented to make sure liquidations are profitable, given the cost of gas.

When a vault is liquidated, a dutch auction is performed. The auction starts slightly below the calculated price of the collateral and goes down over time. Once someone claims the current price, their YAMA is burned in exchange for the collateral. Governance sets the liquidation parameters.